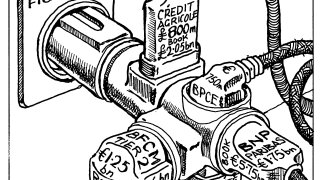

Crédit Agricole

-

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ Size was at upper end of recent range ◆ Book was over €30bn at one point ◆ Portuguese bonds still tight versus peers

-

◆ Italian firm attracts €7bn peak book ◆ Deal lands up to 20bp through govvies ◆ However, high single digit premium still needed

-

◆ First out of three Belgian euro syndications proved a hit ◆ Usual 2bp premium paid ◆ Italy to follow with potential €20bn deal

-

◆ Italian covered supply returns after four month absence ◆ Crédit Agricole Italia set to reopen long end of the curve ◆ Deal expected to come inside BTPs

-

◆ Whether issuer priced through euro curve debated ◆ French bank opting for sterling 'pretty smart tactically' ◆ Euro-sterling cross-currency basis lures other issuers

-

One or two German speaking issuers could issue this week

-

◆ Deal more than twice covered ◆ Pricing tightens 3bp ◆ KfW expected to open supply next week

-

Benchmark funds will pile into core names but January order of business could change as spreads widen

-

French banks' 'intrinsic creditworthiness' not hurt by Moody's downgrades ◆ Some analysts eye relative value plays

-

CA CIB has grown market share in France but its strategy requires keeping its global reach

-

◆ Tenth syndication probably bloc's last for 2024 ◆ Large subscription ratio as usual ◆ January looking 'extremely positive'