Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

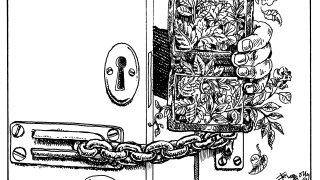

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

Forget tax cuts and bonus caps — ministers were told how to boost the City last year

-

Financial markets are facing a maelstrom, but covered bonds look like an outlier

-

We need to broaden the definition of a greenium beyond new issue pricing metrics

-

Onboarding banks to new fintech platforms is a long and arduous process, bringing into question whether it is worth the effort

-

In a mad rush to attract growth companies to list in their countries, regulators must not forget to protect investors

-