CEE Bonds

-

Banks have two weeks to decide whether to pitch for a $1bn bond for Belarus, having spurned the eastern European country’s last attempt to access investors in 2012, writes Francesca Young.

-

Ukraine needs to restructure its hard currency sovereign debt, and it needs to do it now.

-

Turkiye Vakiflar Bankasi (Vakif Bank) has picked bookrunners for a long-awaited Basel III tier two transaction — the first ever from a Turkish bank.

-

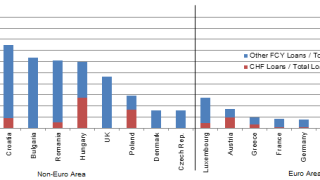

Hungary and Poland’s banks should be able to ride through the Swiss franc storm largely unscathed, despite the large volume of loans still outstanding in the currency in these two countries, said two analysts in London.

-

Sekerbank is holding investor meetings for a covered bond which will be the bank’s first ever international bond issue. It will also be the first ever public Turkish covered bond.

-

Akbank TAS is out in the market with a new dollar bond, a week after the Turkish sovereign made its 2015 debut. The bank is making an opportunistic move to take advantage of tight spreads caused by a flight to less volatile credits across CEEMEA.

-

Russian steel company Severstal has announced a buyback of up to $600m in aggregate of its 2016s and 2017s via Citi and JP Morgan.

-

Speculation is building over whether Western banks will pitch for a bond deal requested by Belarus. The eastern European country, a dictatorship with a poor human rights record, released a request for proposals at the end of last year. However, when Belarus last released an RFP for a bond in 2012 investment banks refused to get involved. The discussion is especially pertinent as Belarus has asked banks to highlight whether they are sanctioned by the US or EU, effectively ruling out business with the Russian state-owned banks.

-

Evraz, the Russian steel and mining company, has closed the tender offer on its 2015 notes after investors accounting for $278m of Evraz's $576.7m 2015 notes agreed to a company buyback of the note.

-

A €5.5bn order book helped the Slovak Republic price its new 12 year euro bond in a record 2.5 hours on Tuesday morning. Strong credit fundamentals which led to a rally across Slovakia’s curve have enabled the borrower to price at its lowest ever yield for a long dated euro bond.

-

Ukraine needs to restructure its hard currency sovereign debt, and it needs to do it now.

-

The Slovak Republic has launched its new 12 year euro bond at 56bp over mid-swaps after a quick 2.5 hour execution process that began on Tuesday morning.