CEE Bonds

-

The Slovak Republic has mandated banks for a 12 year euro-denominated bond. With the sovereign’s curve trading tightly, bankers are suggesting that Slovakia may need to pay a decent new issue premium to tempt investors.

-

Emmanuel Smiecench has left Société Générale where he was head of SSA syndicate in London, covering both emerging market and investment grade deals.

-

Fitch on Friday downgraded Russia’s credit rating to BBB-, one notch above junk status, but trading in the bonds hardly budged as investors are already pricing Russia in the same area as sub-investment grade sovereigns.

-

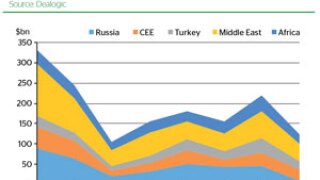

A Russia-shaped void opened up in the central and eastern European loan market in 2014 — one that is still gaping, writes Dan Alderson. This and the wider region’s economic challenges are prompting Western banks to shift their weight to other areas such as Africa, Turkey and Kazakhstan.

-

The Republic of Turkey re-opened the CEEMEA bond market in 2015 on Wednesday with a $1.5bn tap of its 2043s. Turbulence across EM and falling oil prices played to Turkey’s favour with the bond offering a haven to nervous investors. But as a result of the recent volatility, the country paid a decent new issue premium, bringing in a $5bn book.

-

Vakifbank will apply to Turkish authorities to establish a participation bank with $300m equivalent of paid up capital and a registered capital ceiling of TL1bn ($432m), the bank announced this week.Meanwhile, rival Turkish Islamic financial Bank Asya, while responding to an official investigation of its Bursa branch, completed a capital raise and announced the sale of a stake in Tamweel Africa Holding.

-

A wave of Russian corporate debt rescheduling, defaults and renationalisations is inevitable this year, a senior banker and emerging market analyst have warned. However, the claims angered officials at Western lenders heavily exposed to Russian loans and bonds, writes Dan Alderson.

-

The Republic of Turkey re-opened the CEEMEA bond market in 2015 on Wednesday with a $1.5bn tap of its 2043s. Turbulence across EM and falling oil prices played to Turkey’s favour with the bond offering a haven to nervous investors. But as a result of the recent volatility, the country paid a decent new issue premium, bringing in a $5bn book.

-

The Republic of Turkey re-opened the CEEMEA bond market in 2015 on Wednesday with a $1.5bn tap of its 2043s. Turbulence across EM and falling oil prices played to Turkey’s favour with the bond offering a haven to nervous investors. But as a result of the recent volatility, the country paid a decent new issue premium, bringing in a $5bn book.

-

Analysts are concerned that New World Resources, the Czech coking coal producer, could need a new debt restructuring, after it struck deals to sell coal that could leave it still leaking cash.

-

The deadline to submit bond market strategy recommendations for Romania is Thursday.

-

The Republic of Turkey, one of the emerging market countries expected to benefit from falling oil prices, is reopening its 2043 bonds today.