Cartoon

-

The IPO market looked on in despair on Wednesday as Deliveroo, the UK food delivery company, began trading. The stock fell more than 20% in early trading and shell-shocked bankers fear that IPOs planned for after Easter may have to be put on hold. Sam Kerr reports.

-

The Republic of the Philippines sold its first zero-coupon bond in the Japanese market this week.

-

Austrian utility company Verbund this week did something no European issuer has ever done when it sold a single bond that had its use of proceeds tied to green and sustainability-linked metrics. This is an excellent development for the ESG market, and finally covers glaring weak spots in the effectiveness of green bonds.

-

The European Union will complete the funding for its Support to Mitigate Unemployment Risks in an Emergency programme next year, rather than this summer as previously planned.

-

Tricor Holdings, owned by investment firm Permira, has brought a rare dividend recapitalisation deal to Asia’s loan market. Pan Yue reports.

-

Inflated order books are only becoming more prevalent thanks to the European Central Bank’s increased firepower. The way to properly deal with this issue is through a collective effort from every corner of the capital markets.

-

It was a long time coming, but Greece finally completed its curve with a 30 year bond on Wednesday. This was its first in the tenor since before the global financial crisis. The bond was a success, despite a choppy backdrop.

-

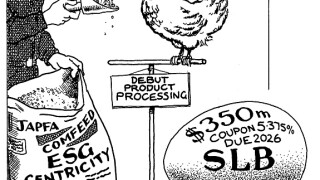

Japfa Comfeed Indonesia sold the country's first sustainability-linked bond this week, leveraging the market fervour for environmental, social and governance (ESG) investing to tighten pricing more than it would have for a conventional deal. Morgan Davis reports.

-

There are more risks than rewards for banks in the primary market right now.

-

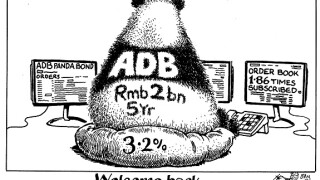

The Asian Development Bank broke a decade-long absence from China’s domestic market to price a Rmb2bn ($307m) Panda bond at a record low spread this week. Its assistant treasurer told GlobalCapital that the multilateral development bank is open to selling longer dated and green renminbi-denominated deals. Addison Gong reports.

-

The London listing review, out this week, has been hailed as a vital chance for the City to straighten its slipping crown as Europe’s top financial centre.

-

The US convertible bond market is charging ahead despite a sell-off in technology stocks over the past fortnight, with multiple jumbo transactions this week from some of the world’s best known companies. The frenzy has left many wondering what it will take to derail one of the hottest corners of the capital markets. Aidan Gregory reports.