Cartoon

-

Investors showed an affinity for highly rated subordinated insurance debt offering ample new issue premium

-

The two-part trade attracted strong demand from deal-starved investors as the sovereign became realistic on pricing

-

-

Though EM bond markets are in a torrid state, spreads have held in. It suggests the worse could be yet to come

-

Demand for the Dutch green debut was four times greater than for BSH’s Pfandbrief

-

-

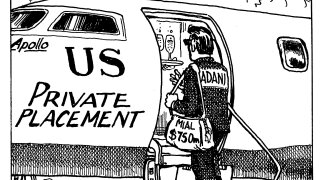

Uncertain market conditions are prompting issuers to hunt down different ways to raise money

-

European banks set to pay up as they look to issue ahead of an uncertain second half

-

Middle managers blocking working from home paint themselves in a terrible light

-

Bankers are hopeful that FIG borrowers who pay for debt in dollars will continue to take advantage of sterling and Swiss franc funding arbitrage

-

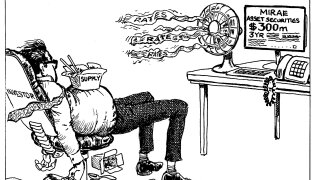

South Korea’s largest securities house calls off deal after lukewarm response

-

TD has raised the equivalent of $6bn in the covered bond market over the past two weeks