BNP Paribas

-

Cadent Gas launched what by some counts is only the second transition bond on Wednesday and achieved a stellar reception in the market. The €500m no-grow bond was priced without a new issue concession and tightened sharply on the break, according to a banker on the deal.

-

Korian, a French owner and operator of care homes, issued a new €400m seven year convertible bond on Tuesday, as equities rallied on hopes of central bank stimulus to combat the economic cost of the Covid-19 corona virus outbreak.

-

US corporates leapt on the chance to print euros this week, with Honeywell, Berkshire Hathaway and Schlumberger all finding plenty of demand in the currency.

-

Relx, the UK specialist publisher, reopened the European corporate bond market on Tuesday after more than a week without any benchmark issuance. It was a convincing €2bn issue, but Relx had to pay double digit new issue premiums.

-

TCC Group, controlled by Thai billionaire Charoen Sirivadhanabhakdi, has agreed a $10bn two year loan to support its bid for Tesco’s Asian assets.

-

Ireland's Electricity Supply Board has become the first utility in the country to sign a sustainability-linked loan. Bankers say there is still a lot of untapped potential in Europe's high grade sustainable lending market.

-

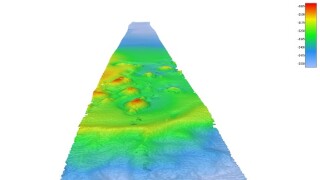

The only high yield bond deal being actively marketed in euros this week has been postponed. The deal was for Fugro, the Dutch company that provides geographical data and asset integrity services to onshore and offshore industries. It was a debut issue for a listed company with no sponsor involved, so there had been good interest, but market conditions just proved too difficult.

-

Zhejiang Geely Holding Group Co netted $400m from its bond sale on Thursday, as the market battled falling sentiment.

-

-

-

China Three Gorges Corp, the Chinese state-owned power company, has successfully offloaded €292m of stock in Portuguese energy firm Energias de Portugal, despite four straight days of heavy losses in European equity markets, due to the spread of the Covid-19 coronavirus across the continent.

-

Unédic was almost three times covered for a 10 year bond on Thursday, with the leads pointing to the relative value of the trade and the quality of name as the factors behind its success against a difficult market backdrop.