BNP Paribas

-

Indian solar power company SB Energy pulled its planned dollar bond late on Monday after grappling with a soft market backdrop and investor demand for a juicy premium.

-

Bank Rakyat Indonesia has opened a $1bn loan into general syndication with a group of 10 lenders at the helm.

-

Tennet, the Dutch utility, has mandated for a long-telegraphed green hybrid bond, as the company looks to protect its credit rating during stakeholder discussions with the German and Dutch governments.

-

Oatly, the Swedish oat milk producer, is taking on debt to finance building two new factories with its first ever syndicated loan, and naturally chose a sustainability-linked instrument, its chief financial officer said. Those hoping for an IPO will have to wait a while longer.

-

Thai oil and gas company PTT Public Co sold the first 50 year bond from an Asian corporation on Thursday, raising $700m from a tightly-priced deal.

-

US corporate bond issuers got straight back to business after the July 4 weekend as 11 borrowers raised $10.8bn, though the volume of issuance is tapering off as companies head into earnings blackouts.

-

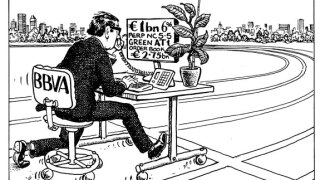

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

-

Following the sale of its third syndication of the year this week — a €3bn inflation-linked bond — France does not expect to bring any more public benchmarks in 2020.

-

Philip Hertlein, the former head of SSA origination and syndication at LBBW, has joined BNP Paribas’s public sector debt capital markets desk.

-

Unédic came to the market for its third social bond on Thursday after making its debut in the format less than two months ago. The deal extends the French agency’s social curve out to 15 years and completes its €10bn explicitly guaranteed funding allowance for 2020.

-

Property managers Zhenro Services Group and Greentown Management, along with developer Ganglong China, all priced IPOs this week, albeit with different responses from the market.