BNP Paribas

-

The European Investment Bank announced its first euro benchmark of the year on Wednesday, looking to take advantage of a super strong backdrop and avoid an expected heavy pipeline of supply next week.

-

Europe’s primary equity-linked market has reopened for 2021, with a debut €200m green convertible bond issued by Voltalia, the French renewable energy company.

-

BNP Paribas offered investors their first chance to pick up sterling paper from a financial institution this year, printing 10 year paper on Wednesday at a cheap level compared to its outstanding euro and sterling curves.

-

Europe’s investment grade corporate bond market continued its blazing start to the year on a busy Tuesday with trades coming flat to or through secondary curves, and syndicate bankers say the blistering momentum is set to last throughout January.

-

Standard Chartered and Crédit Agricole jumped into the long end of the yield curve on Tuesday, as the pair looked to harness the desire for long-dated dollar debt.

-

A pair of senior non-preferred bonds from Swedbank and Société Générale on Tuesday followed Monday’s opener from ING. With three household names now having established pricing points, rarer borrowers are starting to fill the pipeline.

-

The Republic of Slovenia has repeated its 2020 feat of being the first sovereign issuer in CEEMEA to launch a bond by coming to the market with a mandate on Tuesday. Despite the apparent rush for bond funding, however, many believe that EU funding will provide some of what CEE countries would otherwise have taken from public bond markets.

-

American insurers Metropolitan Life and Athene Holding had a busy start to the year as they tapped the sterling, euro and dollar markets to issue a quartet of funding agreement backed (FAB) securities.

-

Hong Kong’s block market surged back to life on Monday night with a flurry of share sales worth a total of HK$14.19bn ($1.83bn).

-

Nobody will forget 2020 in a hurry. It was the year in which a coronavirus pandemic swept across the globe, created economic chaos and forced central banks into swift action. The resulting measures helped to underpin financial markets, bringing yields from record highs in March to record lows in December. But the outlook has always remained uncertain for banks and insurance companies, whose balance sheets are yet to feel the full impact of the crisis. In such a testing year, GlobalCapital wanted to reward the bond deals that achieved stand-out results for issuers — in terms of pricing, execution and timing. The winners are presented here.

-

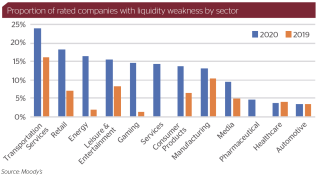

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

This year proved to be one of the most dramatic on record for corporate financiers as volumes rose from the ashes of the market sell-off. David Rothnie examines some of the themes that defined the year and looks ahead to 2021.