Belgium

-

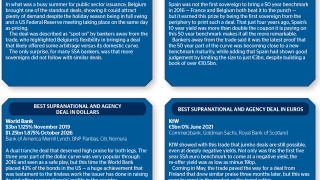

Belgium hit a landmark on Tuesday, printing its biggest deal ever with a 10 year benchmark. Scoring a more modest €1bn, African Development Bank's second ever euro syndication also met with a warm reception.

-

Belgium will become the third sovereign in 2017 to issue a benchmark, mandating four banks on Monday to sell a euro bond.

-

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

Major banks face a tight run-in to meet European initial margin rules on uncleared derivatives, with a January 16 deadline giving little time to make final preparations once market participants return following the Christmas break.

-

The European Commission has determined that India, Brazil, New Zealand, Japan Commodities, United Arab Emirates and Dubai International Financial Centre have equivalent regulatory regimes for central counterparties (CCPs) to the European Union.

-

Equity-linked bond bankers are looking forward to a lively year for issuance in Emea in 2017, as they believe market conditions will favour the product and a wide variety of issuers will find it useful.

-

Greenyard, the Belgian fruit and vegetable producer, priced a €125m convertible bond on Thursday as part of a wider refinancing package to save it more than €15m a year of funding costs.

-

All central counterparties, by their nature, are systemically important. But some are more systemic than others. Regulators should adopt a more tiered, and more technological approach to CCP recovery and resolution.

-

The Belgian Debt Agency has announced its funding target for 2017 and has left open the possibility of printing a first ever publicly issued inflation linker.

-

Political uncertainty and a tough economic outlook across the EMEA region will leave companies no choice but to operate with caution in 2017, focusing on balance sheet repair rather than expansion, rating agency Fitch said in a report on Tuesday.

-

Clearing houses, lawyers and derivatives specialists have spent this week poring over Europe’s proposed rules for central counterparty recovery and resolution, with question marks still hanging over how each case will be assessed and how banks should capitalise their exposures.

-

The European Commission has proposed rules aimed at minimising the systemic risk of recovering and resolving central counterparties that fail, including granting authorities powers to intervene, having projected that 70% of the $500tr over-the-counter derivatives market will move to being cleared.