Belgian Sovereign

-

Two more public sector borrowers brought strong trades to finish a bumper week of dollar deals, both printing $1.5bn of short end dollar paper.

-

A glut of short end dollar issuance this week is set to ramp up on Thursday, after a pair of rare names in the currency mandated on Wednesday. The trades will follow a strong showing from Finnvera after the Finnish agency — also an uncommon name in dollars — printed its largest ever trade in the currency.

-

Strong short end dollar demand led a host of issuers to print tight deals this week, including one debut. Investor appetite is expected to stay strong, but bankers are sceptical that there will be much supply.

-

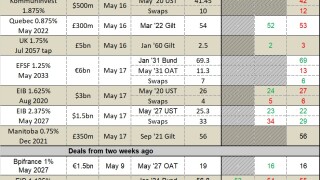

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

-

The euro market, despite a week shortened by European holidays, churned out a steady diet of solid deals. The French election, credited with triggering the rally, is growing more distant but the bid for quality fixed income paper remains as healthy as ever.

-

The Flemish Community’s second ever outing in the public debt market raised €1.25bn over two tranches, pulling in large books and setting the final spread 4bp inside guidance on one of the legs.

-

The Kingdom of Belgium hit the long end in euros on Tuesday, taking advantage of a healthy market to raise €3bn with a 20 year bond. Meanwhile, Nederlandse Waterschapsbank (NWB) announced a tap of a 2041 line.

-

The Export-Import Bank of Korea (Kexim) priced a five year euro benchmark on Monday, nipping in with a one day execution ahead of a trio of deals scheduled for Tuesday.

-

Bpifrance Financement broke its size record on Tuesday, nipping back into capital markets ahead of several of its compatriots, according to a funding official at the issuer. The European Investment Bank (EIB) and NRW.Bank also made the most of the stable conditions, printing their own benchmarks.

-