Belgian Sovereign

-

While the French presidential race put many eurozone issuers under pressure this week, some found the conditions ideal, locking in low rates while they could.

-

Political volatility in France has buffeted the euro market this week, leaving some public sector issuers floundering as government yield curves spiked. Other issuers have had no such troubles though, thriving amid the turmoil.

-

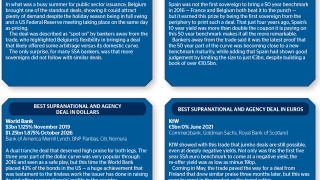

Belgium defied turmoil afflicting European government bond spreads this week, pulling in big books for a dual tranche euro benchmark. The sovereign's success may have emboldened Finland to follow suit with its own barbell transaction.

-

The market for public sector euro issuers is springing back to life after a quiet week, with two benchmarks printed on Monday and a sovereign dual tranche expected on Tuesday. But although traffic is returning, conditions are no longer as supportive as in January.

-

-

Euro bonds at the 10 year maturity and beyond have proven difficult so far in 2017, but a strong performance from the European Investment Bank may have shown other issuers what it takes to pick up size at long maturities.

-

Belgium is hoping to revisit the distant reaches of its euro curve, telling GlobalCapital that it is looking at selling 40 year debt in 2017.

-

Belgium hit a landmark on Tuesday, printing its biggest deal ever with a 10 year benchmark. Scoring a more modest €1bn, African Development Bank's second ever euro syndication also met with a warm reception.

-

Belgium will become the third sovereign in 2017 to issue a benchmark, mandating four banks on Monday to sell a euro bond.

-

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

The Belgian Debt Agency has announced its funding target for 2017 and has left open the possibility of printing a first ever publicly issued inflation linker.

-

Flemish Community made its euro benchmark debut on Tuesday with a €1.25bn dual tranche Reg S deal.