Barclays

-

Emerging market issuers are hesitant to rush back into the market in the new year. Most are waiting on the sidelines until the tone becomes more settled and investor desks are fully staffed.

-

-

The European Investment Bank and KfW comfortably raised a combined £2.25bn on Thursday after receiving whopping investor demand for benchmark trades. This Friday is set to add to the sterling glut, with deals from the Asian Development Bank, Bank Nederlandse Gemeenten and Swedish Export Credit Corporation.

-

Israel has opened the CEEMEA primary bond market for the year, mandating three banks for a euro denominated 10 year and/or long dated benchmark Reg S note.

-

Barclays has asserted its credentials as Europe’s top investment bank with market share gains in 2018, but can it shake off lingering doubts about the franchise, asks David Rothnie.

-

KfW and the European Investment Bank mandated banks on Wednesday for the first sterling SSA deals of the year. Public sector borrowers are looking to pile into the sterling market before the crunch vote by the UK Parliament on Theresa May’s Brexit deal in mid-January, with deals expected in both Sonia-linked and fixed rate formats.

-

The global high yield bond market has produced $320bn of new issues in 2018, up to December 21, 43% down on last year’s total of $563bn, according to Dealogic. Sentiment has turned progressively more bearish as the year has worn on, with concerns about US-China trade hostility and overvaluation of US equities biting.

-

Conditions have rarely been sweeter for European borrowers seeking to diversify their funding sources. Europe’s dominant private debt markets for investment grade issuers, the US private placement market and the Schuldschein, are thriving, and agents in both are on the hunt for new borrowers. Their search will better if, as expected, public bond markets have a tough 2019. Silas Brown reports.

-

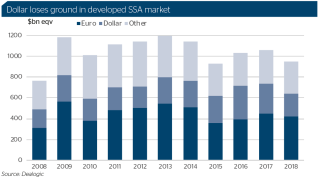

SSA euro issuance outstripped dollars this year, thanks to strong conditions in the first half and the vagaries of the basis swap. But the end of eurozone quantitative easing and political strife made it a trickier place later in 2018 — and those elements are unlikely to disappear in 2019.

-

The dollar SSA market at the end of 2018 was in stark contrast to euros, despite the latter outstripping it in volume over the year. Even uncertainty over the Federal Reserve’s rate path in 2019 seems unlikely to shake the fortitude of the currency as a funding source for SSAs. But finding windows could become trickier as the Fed pulls liquidity amid global trade wars and rising populism.

-

Corporate bond bankers in the US are predicting a further 10% fall in dollar supply in 2019 as more volatility and an expected fall in US M&A activity hits issuance. The predictions come after supply for December hit its lowest level on record.

-

Due to the lack of new issuance for over a week in the European corporate bond markets, the vote of no confidence in UK prime minister Theresa May was the talk of both the buy and sell sides on Wednesday morning. But there has been little effect on the market itself so far where political developments in other European states are more of a concern.