Banks

-

Tone is ‘not exactly great’ for the primary SSA market this week

-

Santander and EFG Bank find success as Swiss market gears up for rate cuts

-

Outgoing head of UBS Investment Bank has steered it through tumultuous times

-

Some bankers were surprised, others not, but all expect a reduced EU funding programme for 2024's second half

-

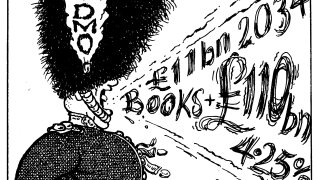

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

HSBC and Manulife among global names finding strong investor support in the Lion City

-

Canadian issuer taps into three different currencies within one week

-

Bank fills gap as it aims to build financial institutions business

-

Issuer decided not to delay but leads say ‘something’s missing’ about the market

-

Canadian issuer takes bigger amount than originally targeted

-

'Textbook execution' lands sovereign issuer 'blowout deal'

-

Changes follow promotions of Rombouts and Fine