Banks

-

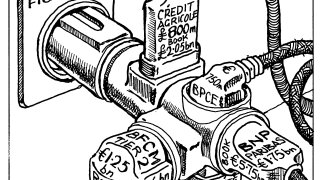

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ Landesbank delays covered funding as it prints second senior preferred three months after debut ◆ Varying views on concession, minimum 5bp paid ◆ Strong backing by German bank investors

-

◆ Italian bank overcomes slower day in primary with first FIG dual tranche deal of year ◆ Why issuer chose twin tranches ◆ Concession discussed

-

◆ Issuer matches previous record ◆ Pricing level was 'never a question' ◆ Market shrugs off Gilt selling

-

New leadership must be bold if it is to silene the doubters and ensure the the new-look corporate and investment bank delivers on its promise

-

◆ French bank prints third syndicated deal in just two days ◆ Frequency of visits means issuer has to pay up ◆ Euro tier two ‘better received’ than sterling tier two

-

◆ Size was at upper end of recent range ◆ Book was over €30bn at one point ◆ Portuguese bonds still tight versus peers

-

◆ Deal lands with low single digit premium ◆ Investors propel book to almost €5bn ◆ Trade already tighter in secondary

-

◆ Berlin deal “full success” ◆ Länder segment expected to keep busy ◆ Rhineland-Palatinate prints big, retains bonds

-

Senior banker arrives to work in financial advisory

-

◆ Investors not chasing last few basis points ◆ Minimal premium paid ◆ Caution on sterling paper

-

◆ Four deals priced at same tenor, with a fifth also in dollars ◆ Why IADB increased size ◆ Swap spread moves cause complications