Banks

-

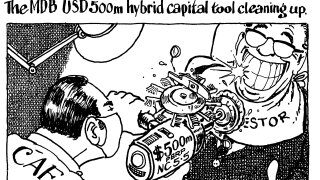

Islamic Development Bank deal sold inside the curve

-

-

◆ Italian bank prints €1bn in first tier two since January 2024 ◆ Demand for higher yielding deals outweighs Middle East escalation ◆ Other new financial issuers of capital line up deals

-

Bank has raised DCM team leaders after round of departures

-

◆ Minimal impact from escalating Middle East conflict ◆ Investors eager to buy long end BPCE ◆ Danske lands flat to Pfandbrief

-

◆ Yankee banks top up regulatory capital ◆ Brown & Brown fund $10bn acquisition ◆ Investors hunt for yield

-

Arrival of head of new CIB will further spur NatWest Markets as broader bank looks to growth

-

◆ Investors scooping tier two debt across markets ◆ BNP Paribas takes advantage with third print of the year ◆ Rare German insurer Gothaer increases funding

-

◆ Old tier two call date approaches ◆ Tier two pick-up over senior gets tighter ◆ Wide range of feedback but ‘can’t compare this to anything’

-

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

◆ Takes larger size than expected ◆ Tightens 3bp to leave minimal premium ◆ French issuers fairly well funded before the summer

-

◆ Record book for an EIB EARN ◆ Demand supports ‘comfortable’ 3bp tightening ◆ Positive backdrop as SSA spreads perform in secondary