Banks

-

Sterling remains king amid end of year flurry of deals

-

High coupon lures investors into £1.8bn orderbook

-

Supranational will return in syndicated format on Wednesday in dollars

-

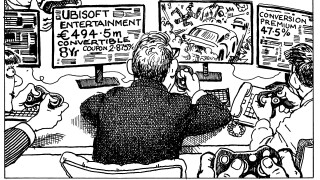

Shares in the French game publisher fell more than 8% after the convertible and delta placed

-

Investors check credit line capacity ahead of deal

-

◆ FIG sterling issuance lagging higher sales of unsecured euros in 2023 ◆ Investors show readiness to buy as Pacific Life's second deal receives stronger demand at tighter spread ◆ UK insurer to offer long tier two

-

Banks may bring forward their 2024 funding plans to snap up duration as investors look to position ahead of predicted rate cuts

-

The US bank has picked the top management of its new-look investment banking division but uncertainty will remain until the restructuring is finalised in 2024

-

Green bond framework update gives investors first chance to buy PPs dedicated to funding nuclear energy

-

◆ Italian bank gets duration in Yankee market that it cannot reach in Europe ◆ The $3bn deal was its biggest for a decade ◆ Global bid for duration allows it to print longest SP dollar deal this year

-

The trade is ‘most likely’ the final syndication this year after issuer exceeded the lower end of its targeted funding range

-

Inverted five and 10 year swap curve means long dated covered bond issuance less attractive than senior format