Banks

-

LBBW and Commerzbank reserve their slots early for first trading day of 2024 with December mandate announcements

-

Swiss regulator recommends fining senior bankers to avoid future bank collapses but faces pushback from Swiss Bankers Association

-

GlobalCapital is proud to introduce the Southies, the premier alternative investment banking awards for 2023

-

The bank's plan to issue a seven year covered bond sets the stage for likely head to head execution with LBBW

-

The seven year Pfandbrief will offer the longest covered bond for more than four months

-

◆ What the most senior debt bankers in the world believe about next year ◆ Who's eating Credit Suisse ◆ If a property company falls in the forest and doesn't make a sound...

-

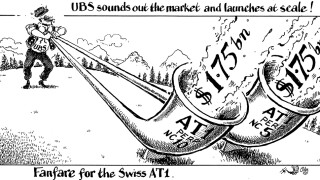

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

When the shockwave set off by the failure of Silicon Valley Bank swept the legs from under Credit Suisse, all the talent and relationships of a big investment bank were up for grabs. UBS has tried to hang on to what it sees as the best bits — but the biggest beneficiaries are likely to be rivals. Jon Hay and David Rothnie report

-

After two years of poor issuance, investment banks may have to cut jobs if volumes don’t pick up in 2024

-

◆ Authority says banks sport best capital ratios ever thanks to improved profitability ◆ With net interest margins having or close to peak this may be about to turn ◆ Major banks unfazed by higher capital requirements as they boast strong buffers

-

Discount retailer’s revenues have grown amid UK cost of living crisis

-

Regular Swiss issuer reopens two covered bonds in last sale of 2023