Banks

-

A year after its surprise scoop of UK equities house Numis, Deutsche Bank is making headway in the league tables

-

◆ 'A nice print' say rival bankers ◆ US bank raised €2.25bn and 'could have taken more' ◆ Green FRN label questioned as 'nobody cares'

-

Redemptions, limited supply and a favourable rates outlook created a window for the issuer

-

Another German agency achieved a greenium to follow on from KfW deal

-

Issuers stick to the Länder rule book to maximise pricing

-

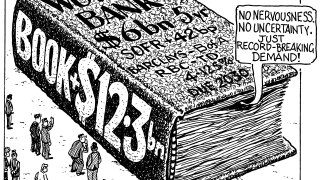

◆ Barclays pushes 'very impressive' AT1 flat to fair value after becoming net negative AT1 issuer ◆ Pension Insurance Corp follows euro peers with tier two ◆ 'Horribly undersupplied' investors pile in orders

-

Scott Kirkby joins from Bupa after stints at NatWest and Credit Suisse

-

Loan and bond distribution merged, new financial and advisory sectors

-

Deal will be secured against a pool of Singaporean residential mortgages

-

◆ Lloyds draws peak book of €5.1bn ◆ BayernLB launches green deal and pays 5-10bp premium ◆ SR-Bank senior preferred

-

German SSA supply set to continue in holiday-filled week

-

Blockchain bonds are usually sold to just one or two investors in the primary market