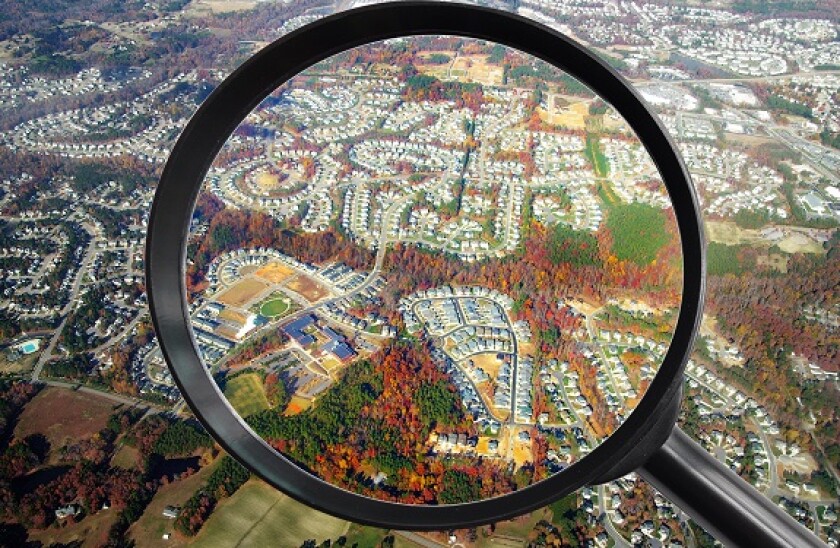

Real estate names pile into debt markets as M&A tipped to soar

Real estate companies are some of the biggest borrowers in Europe this year, with loans for Valor Real Estate and QuadReal Property, a UK/Canadian property joint venture, and Supermarket Income Reit adding to the pile this week.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts