We may be facing a new age of fiscal stimulus and financial repression, via inflation outpacing interest rates, while at the same time quantitative easing has reshaped markets. What does this mean for investors? Investment firm Algebris's latest Silver Bullet post has some ideas.

"Over the past decade, quantitative easing boosted asset prices but failed to boost inflation. It also added to pernicious collateral effects — like corporate and household inequality — by rewarding the haves more than the have-nots," it says.

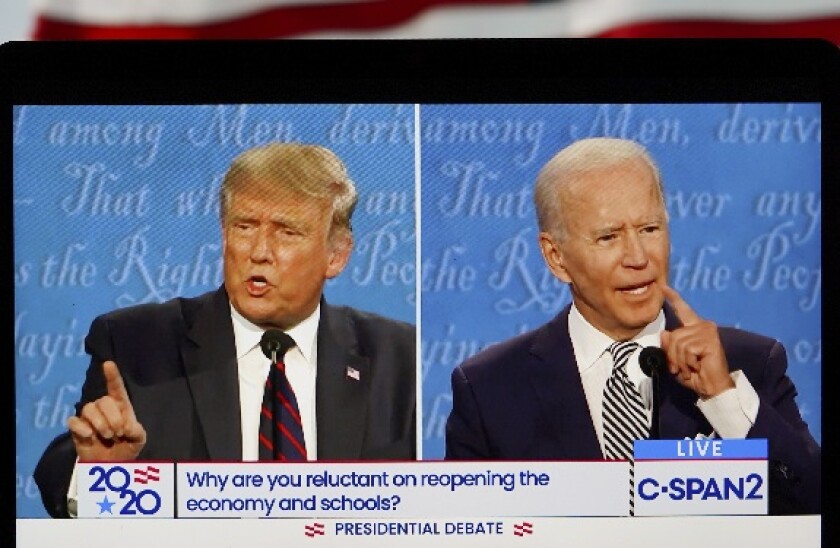

"Today, the political music is changing. The Covid-19 crisis has already highlighted the need for Western governments to not only boost growth, but also invest in social welfare, including healthcare and infrastructure and to reduce inequality. A potential Democratic win at US elections could bring a shift towards helicopter money: more fiscal stimulus to states, local authorities and individuals, combined with dovish monetary policy."

We may finally end up with some more inflation.

But this leaves bond investors "simmering in a boiling pot", Algebris says.

"At current yields, investors have no room for error. The most dangerous security to own in your portfolio is probably long-end government debt: you can either lose money slowly to inflation, or quickly if there’s a repricing of expectations."

Meanwhile, quantitative easing has meant that the sun generally shines on markets, but when it rains, it pours. Scarcer trading liquidity, herding and passive strategies all play into this, Algebris says, while risky and risk-free assets now move in tandem.

In response, Algebris suggests a barbell strategy, where a portfolio is comprised of cash on the one hand and riskier bonds on the other. It also proposes holding on to more liquidity than necessary, to take advantage of dips.

"With binary volatility and high liquidity risk in bond markets, prices may not always reflect fundamentals, and fire sales of high quality assets may occur more frequently than expected. In January this year, we shifted half our portfolio in cash, which allowed us to deploy capital and buy investment grade debt cheaply during the sell-off," Algebris says.

Elsewhere, EY came out with its latest Brexit tracker for financial services this week. It said that in the last few weeks of September, more than 400 financial services job transfers from the UK to Europe were announced, bumping up the total amount of posts leaving the country to more than 7,500 since the Brexit vote in 2016.

EY said that Dublin is the most popular destination for relocations and new European hubs or offices, followed by Luxembourg

“Many financial services firms had implemented the bulk of their relocation plans before the start of the year, and we saw very little movement in the first half of 2020," said Omar Ali, UK financial services managing partner at EY.

"But as we fast approach the end of the transition period, we are seeing some firms act on the final phases of their Brexit planning, including relocations. This is despite the pandemic and consequent restrictions to the movement of people, which is clearly making it harder to relocate people and adds complexity for those who were looking to commute to EU locations."

He said that many companies are still in a "wait and see" mode, so could announce changes once there is more clarity about future trade agreements. But he added: "The clock is running down, and with the possibility of a second Covid-19 spike threatening cross-border movement in the final three months of the transition period, firms must now ensure that as a minimum they will be operational and can serve clients on the 1st of January 2021.”