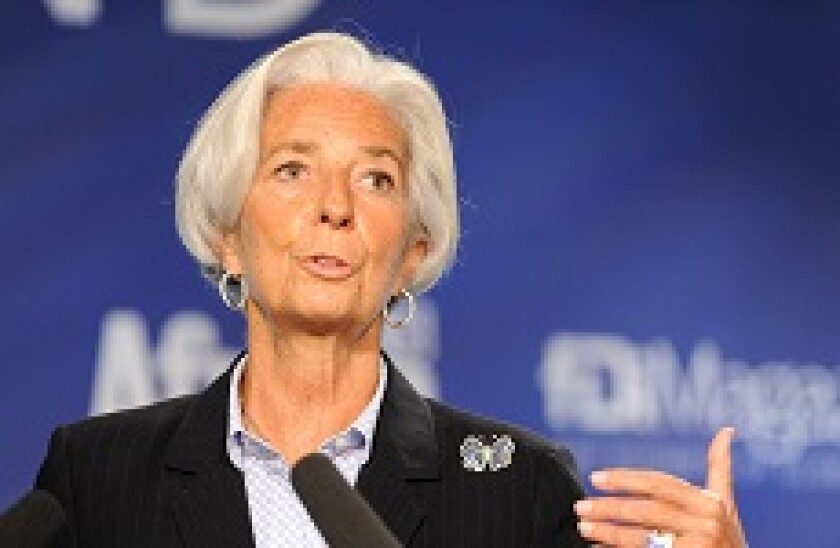

Lagarde hints at further unconventional ECB policy

Christine Lagarde has given a strong hint she will persist with the European Central Bank’s highly accommodative monetary policy if she takes over as its president in November. Lagarde also suggested the ECB would move to make its portfolio more green.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts