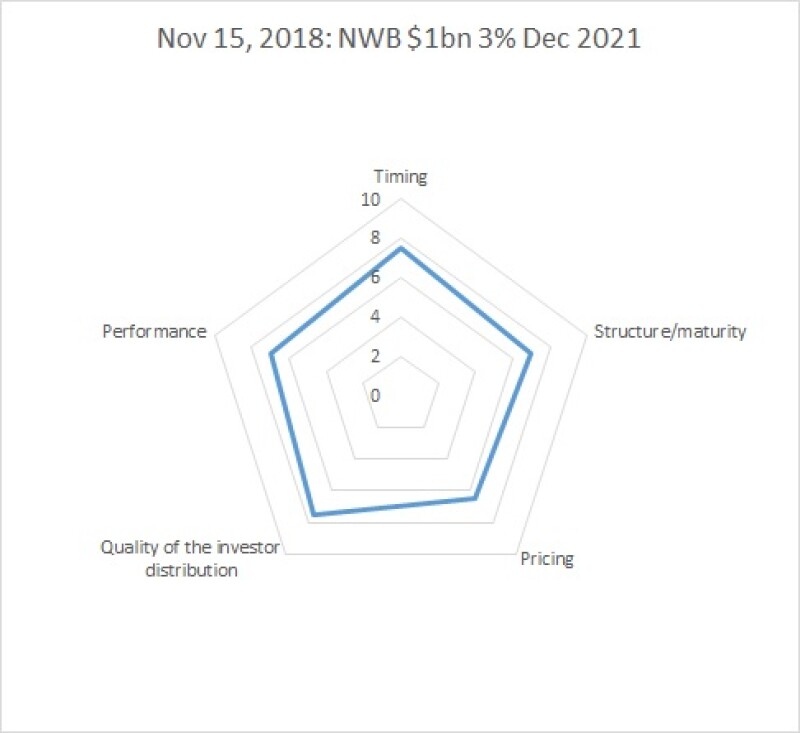

Voters scored the $1bn December 2021 benchmark — the only trade available for scoring in the week commencing November 12 — particularly highly for timing and quality of the investor distribution, which both scored 7.5.

Central banks and official institutions dominated the book, taking 74.5% of the bonds, while the deal had all the attention of the dollar market that week.

The trade came in a dollar market that had been “impressively resilient for months”, said on-looking bankers at the time of pricing.