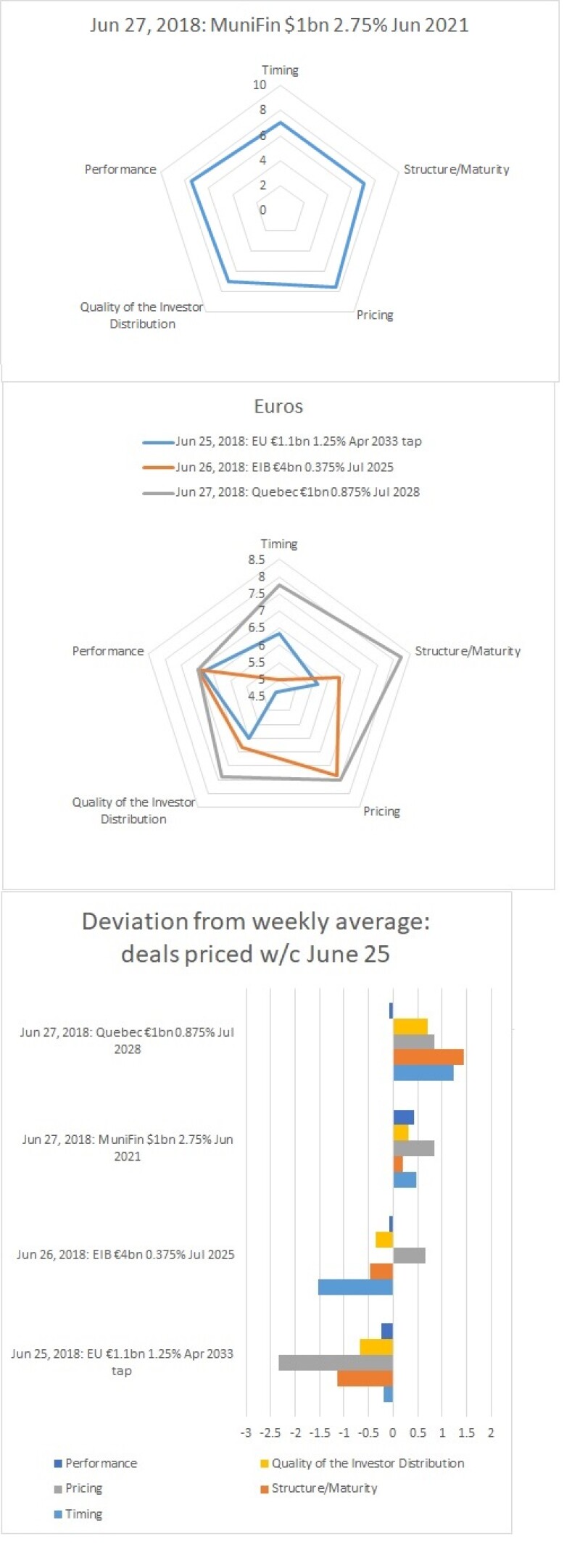

A €1bn 0.875% print from Quebec, led by BNP Paribas, Deutsche Bank, JP Morgan and Société Générale on June 27, scored 7.575 on average across the five deal categories available for voting (timing, structure/maturity, pricing, quality of the investor distribution and performance). Its highest ratings came in the structure/maturity category.

The next highest scorer of the week was a dollar print: a three year from Municipality Finance that was awarded 7.2 on average.

Two European supranationals brought up the rear. European Investment Bank scored 6.4 on average with a €4bn June 2025, and European Union 5.83. EIB was marked down most on timing. European Union had its lowest marks in the pricing category but scored higher on timing and performance.