Now more mainstream than niche, private credit has swelled in recent years to become a critical source of funding for companies in the sub-investment grade sector.

But now private investment is looking for fresh homes for its cash among blue-chip companies.

In April, for example, Apollo and Blackstone led for Boeing a $4bn private credit facility finance an acquisition.

Apollo also committed to £4.5bn in private credit financing for EDF in June.

Meanwhile, it is thought that Meta, parent of Facebook, is in talks with private credit firms for up to $26bn of capital to fund AI data centres.

The traditional argument ran, in the early years of private credit, that lenders there offered greater certainty of execution with a lower burden of disclosure and documentation.

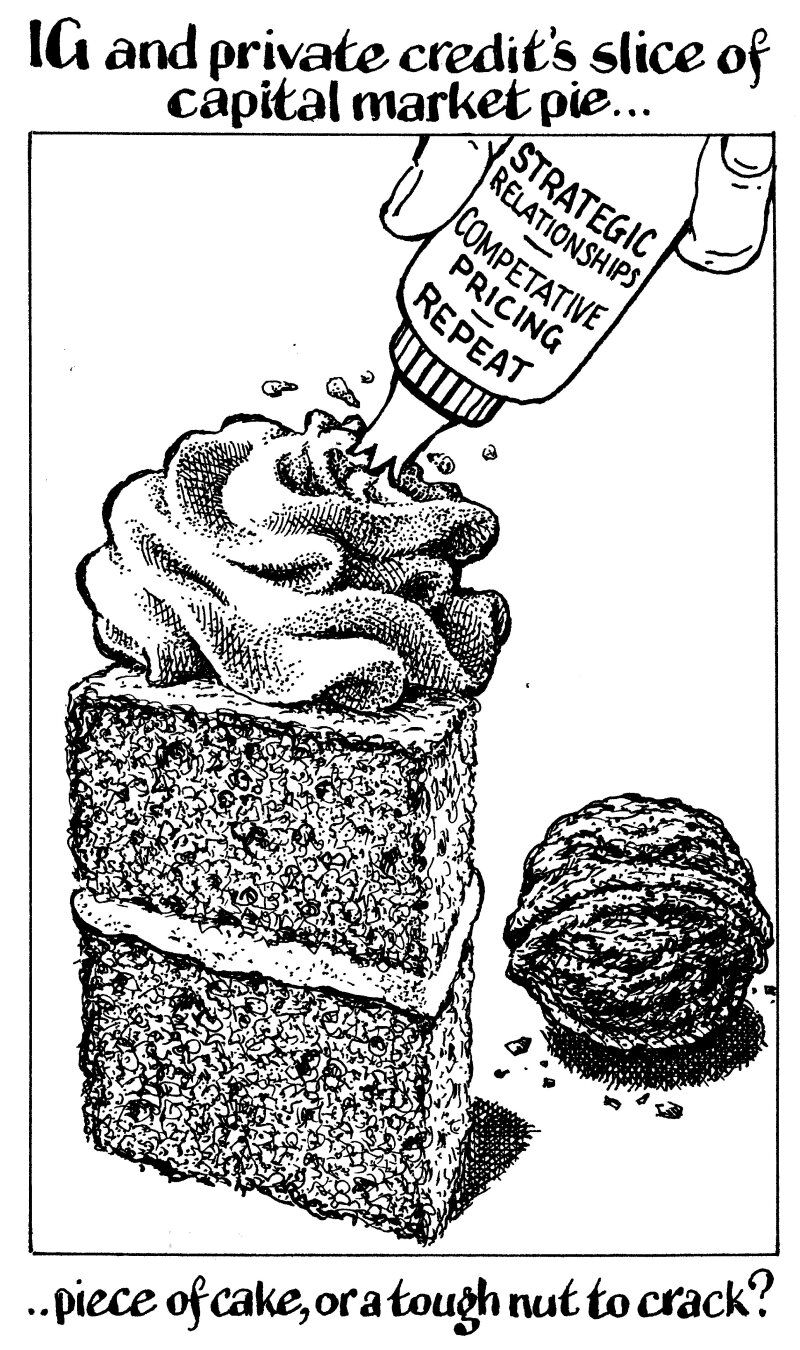

Bank lending to investment grade companies prides itself on offering competitively priced funding, prizing long-term relationships over short-term economic cycles.

The investment grade bond market is more susceptible to those cycles but boasts ready access at tight pricing to the best-known issuers able to meet the disclosure and investor relations requirements.

Certainly the state of the investment grade bond market this year is that companies are meeting waves of investor demand, driving funding to tight spreads.

This, ultimately, is where private credit needs to compete when it comes to doing business with borrowers with ready access to the cheapest funding and where the arguments about lender relationships carry less weight.

Frequent bond issuers also know the value of a strategic relationship with the market — keeping current in investors' minds by bringing new deals every year.

Private credit has evolved to provide ease of execution, structure and stability. But to be the go-to provider of funding for a wider range of blue-chip names, it needs to be just as strategic, rather than a short term funding solution, to clients that have strong balance sheets and reliable cash flows.

It's not enough to offer a cheap deal once; private credit will need to offer competitive costs of funding again and again.