There is an “electronic arms race” going on amongst global banks, says Jeff Feig, global head of g10 fx at Citigroup in New York. While derivatives trading managers in most asset classes fret the effect of Dodd-Frank regulation on their trading capabilities, fx looks to have escaped largely unscathed, therein opening the door for new platforms to take center stage.

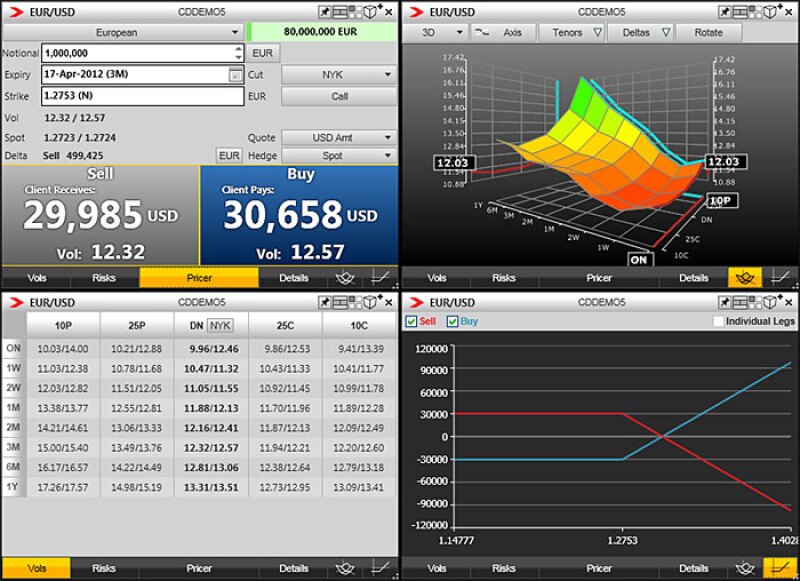

Feig announced the launch of Citi’s Velocity 2.0 platform yesterday, a trading technology which boasts speed, efficiency, and a sleek design, among other things, for fx spot and derivatives. A self-proclaimed Steve Jobs fan “since before it was cool,” Feig appears to be transposing some of the late Apple ceo’s beliefs on how technology should be experienced from phones and laptops to fx trading. Velocity includes an “Options Cube,” or “Volatility Cube,” wherein a single click can flip a screen to six different layouts of options information.

Screen #1: Bid/Ask spread, Desired Notional, Strike, and Expiry for a given currency pair.

Screen #2: Forward details.

Screen #3: Payoff graph per desired option.

Screen #4: Volatility curve.

Screen #5: The option’s risks (Greeks).

Screen #6: Volatility Surface.

As fun as the cube may sound, market participants may be wondering how such a new platform would fit into mostly unfinished clearing and execution requirements under Dodd-Frank. For example, why build a new platform when the requirements and effects of connecting to swap execution facilities remain largely unknown?

But, the U.S. Treasury appears primed to exempt fx swaps and forwards from clearing, while the Federal Reserve has yet to approve a clearinghouse for fx options, signifying to Feig that approximately 90% of the fx market will remain unchanged. Swing away, one might say.

Non-deliverable forwards will almost certainly be snared, though, meaning fx trading divisions will have to station specific salesmen in non-U.S. jurisdictions if they want to trade the instruments without clearing and executing under Dodd-Frank requirements. They may also have to deal only to non-U.S. customers too, though specifics are still hazy.

In the meantime, fx trading managers are likely to continue build-outs. Citi, for its part, plans to launch the 2.0 version of Velocity for fixed income trading in the second half of this year, said officials. Until then, or until further notice, fx traders might try to enjoy the red carpet treatment they should be receiving from electronic trading marketers across the Street.