Swiss Francs

-

Swiss bank hopes to price close to non-preferred comparables

-

More corporates waiting to pounce, but blackouts and Easter set to hamper supply

-

Emerging market appetite to return as Swiss risk sentiment shifts

-

The transaction was priced flat to more established names

-

What the Swiss franc market lacks in size it makes up in pricing

-

Rising swap rates open opportunities for arbitrage at attractive yields

-

TD issues the first euro five year Canadian deal in six weeks and its first euro deal in two years

-

Segro may bring two trancher in euros on Wednesday

-

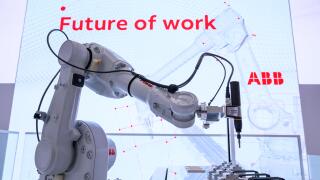

ABB, Bern and BNS showed that the Swiss market is open for well rated deals

-

UK lender finds 5bp-10bp of arbitrage compared with euros

-

ZKB raised Sf160m with the second Swissie deal since Russia invaded Ukraine

-

Volatility freezes Swiss franc pipeline