Sweden

-

A pair of European agencies have increased their funding target ranges for 2018 as they prepare for the second half of the year.

-

Stadshypotek issued a €1bn seven year on Wednesday marginally wider than where DNB Boligkreditt recently issued its much larger green inaugural deal in the same tenor. It followed a €500m five year from Sparebank Vest Boligkreditt.

-

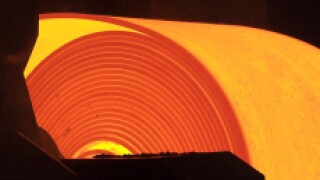

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

It is a mark of how far the market has come from a barren week at the end of May that not just one, but three deals, totalling €2.75bn, were priced on Friday. The European Central Bank meeting and the expectation of a deal from German pharmaceuticals company Bayer played their part in the issuers’ decisions on timing and the order books justified those choices.

-

-

Public sector borrowers looking for dollar funding are likely to have to go even shorter than they have been used to after this week’s Federal Open Market Committee meeting, said SSA bankers.

-

Arion Banki, the first Icelandic bank to list shares since the financial crisis, is set to price the sale at the top of its revised range.

-

Kommuninvest on Tuesday took advantage of a quiet dollar market to sell its largest ever deal, despite only offering a concession of 2bp, according to the lead managers.

-

Sweden’s Lundin Petroleum has slashed 90bp off the margin of its $5bn reserves-based lending facility, as borrowers continue to heap pressure on lenders over pricing.

-

Kommuninvest is out with a dollar trade in what bankers expect to be a fairly quiet week bisected by a likely target rate hike by the Federal Open Market Committee.

-

Bank of America Merrill Lynch has hired a banker from SEB to lead its equity capital markets business in the Nordic region.

-

The highly anticipated IPO of iZettle, the Swedish payments company, has been called off, as PayPal has struck a deal to buy the company.