Sterling

-

◆ Issuers referencing older Gilts to price through euro curves ◆ Syndicate 'overwhelmed' by orders as investors chase French spreads ◆ Transaction 'repriced' secondary curves

-

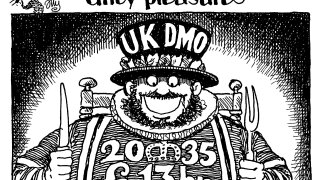

Choice of 10 year tenor key to success, says DMO

-

◆ EBRD priced off primary ◆ KfW achieves greenium? ◆ Tight pricing on both deals

-

◆ Record book and deal size ◆ Investor demand 'at odds' with media headlines ◆ Key BoE actor clears up position

-

◆ Issuer initially targeted price over size but achieved both ◆ Makes sterling debuts look easy ◆ Positioning for UK membership?

-

◆ Three big SSA syndications scheduled for Tuesday ◆ EU and Italy on the same day, again ◆ UK to bring second to last syndication this FY

-

Embattled utility makes final plea for court to sanction £3bn in emergency funding

-

Thames Water refinancing battle is an unedifying mess

-

As Ares raises the largest direct lending fund, Goldman Sachs reorganises to serve the trend

-

The renewable energy company will use proceeds from the sale of its stake in a windfarm to pay down drawn balance

-

◆ Offshore issuers targeting 6NC5 sterling senior ◆ Real money bid for sterling FIG remains ◆ Swedbank persuaded to print more

-

Euro and sterling investors snap up fresh deals as Europe enters blackout