Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

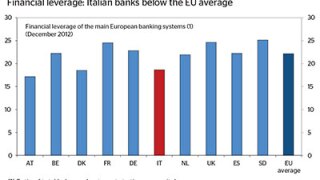

The Italian banking system has been surprisingly resilient since the crisis, but profitability is weak and loan quality poor, with the ratio of NPLs having almost tripled since 2007. Elliot Wilson investigates what Italy’s banking sector is doing to restore profitability and the how it is affected by Basel III and bail-in requirements.

-

In spite of serious restructuring at many Italian banks in the past two years, their names still appear high on the list of investor concerns ahead of the European Central Bank’s comprehensive assessment that is published later this year. The banks say they are ready. Tom Porter finds out if they’re right.

-

Italian banks’ borrowing costs have tumbled in the past two years, even as the economy has been stagnant and asset quality has deteriorated. But with the European Central Bank (ECB) and Bank of Italy helping banks shape up their balance sheets, there is a genuine feeling that this year could be the final stretch on the road back to normality.

-

Since 2011, bank lending has plunged in Italy, posing serious problems for the country’s small and medium-sized enterprises. Amid bold reforms to remedy the problem, Italy has created something new for Europe — a minibond market to channel institutional funds to SMEs. As Stefanie Linhardt reports, the market is still in its infancy, but investment funds are being formed and dealflow is expected to accelerate.

-

Italian issuers were able to draw on the country’s enviable pool of retail investor cash when times were tough at the height of the eurozone debt crisis. But with credit spreads screaming in as the crisis abates, borrowers are getting creative to keep this sophisticated group interested, while opportunities are opening for new issuers. Craig McGlashan reports.

-

The equity capital markets in Italy are expected to be busy in 2014. As banks rebuild their capital bases and the government embarks upon an ambitious privatisation scheme, market participants are optimistic about a return to form for the Italian equity sector, finds Nina Flitman.