Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

The second visit by a non-European supranational to the euro benchmark market since the euro/dollar basis swap neared parity late last year could encourage its peers to print in the currency over the coming weeks. The Asian Development Bank’s debut euro benchmark this week offered more enticing pricing than when the World Bank opened the market late last year — but by printing a larger deal, it was equally if not more impressive in many bankers’ eyes.

-

-

Brussels-Capital Region wants to raise €70m in private placements by April 8 but is receiving more inquiries for longer tenors than it wants to print. French regions could look to take advantage of the excess demand and print longer notes, according to medium term note dealers.

-

Strong Asian demand helped the North Rhine-Westphalia increase the size of its first benchmark of the year on Wednesday, despite the issuer pricing the bond at the tight end of guidance.

-

Uncertainty over the status of bonds under the rules for the Basel III liquidity coverage ratio is making some SSA issuers nervous and helping to widen the spreads of borrowers on the cusp of falling into the second tier.

-

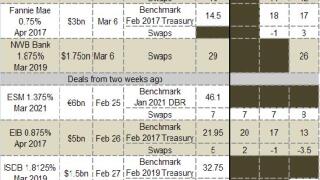

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.