Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

Région Île-de-France highlighted the appeal of socially responsible debt on Monday when heightened international demand for a 12 year SRI bond allowed the region to sell its biggest ever deal.

-

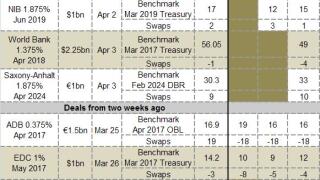

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

French regions will sell a spate of private placements in the coming weeks despite a sluggish start to the year, according to medium term note dealers. Bankers expect the borrowers to print larger and longer notes than last year.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

German pension funds have joined Japanese investors hunting for long dated paper from sub-sovereigns, according to medium term note dealers. German regions are beginning to tap the demand and push further out the curve — State of Brandenburg is set to print a seven to 12 year note this month.

-