Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

-

Lesser rated corporates and emerging market names could be the biggest primary market beneficiaries of the Swiss National Bank’s shock decision to dump its exchange rate ceiling and cut interest rates on Thursday, writes Lucy Fitzgeorge Parker.

-

The European Financial Stability Facility has opted for an unusual maturity with its first benchmark of the year — set to be priced on Tuesday — in an effort to attract bank treasury accounts. The EFSF follows a 10 year euro benchmark from the Province of Ontario on Monday.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Market participants have been dealing with a raft of regulation since the global financial crisis first hit seven years ago. While those in the sovereign, supranational and agency business welcome a stronger banking system and more robust markets, they are increasingly worried about the unintended impact of policymakers’ actions. Tessa Wilkie reports.

-

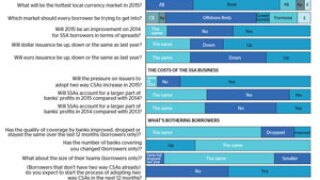

As more and more borrowers line up to join the offshore renminbi market, Asian currencies look set to play an increasingly important role for SSA issuers in the year ahead. Jonathan Breen finds out which local currencies borrowers and bankers are placing their bets on.