Top Section/Ad

Top Section/Ad

Most recent

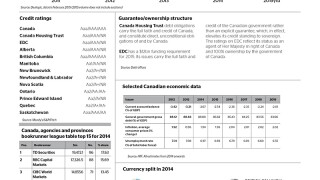

First Canadian province to visit euros in 2026

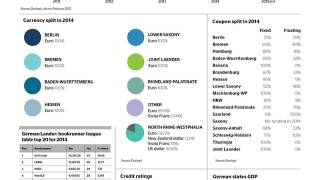

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad