Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

There was a very interesting moment for Leak this week when sifting through the responses from MTN bankers asking about voting in this year’s Bond Awards.

-

A 12 year socially responsible benchmark from Île-de-France on Tuesday fell short of full subscription as investors shunned the print because of the low yield on offer.

-

Île-de-France is set to sell its second ever socially responsible bond on Tuesday, announcing a trade soon after a sustainability bond from Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden (FMO) on Monday.

-

The Eurosystem started lending out securities it bought in its quantitative easing programme last week, but the scheme shows how little confidence European central banks have in the continent's government bond markets.

-

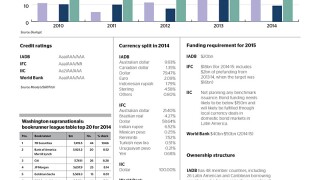

GlobalCapital anonymously polled senior bankers in the public sector bond markets to find out their perspective on the outlook for the business this year and what their key concerns and hopes are for the sovereign, supranational and agency sector in 2015.