Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

The SSA market got back to business swiftly, if somewhat cautiously, this week, with taps and private placements (PPs) across core currencies coming quickly after the UK’s vote to leave the European Union. Although none of the trades were especially ambitious, their success has set a positive tone for the weeks to come.

-

The SSA market is bouncing back from the Brexit shock more strongly than many bankers anticipated, as the State of Hessen picked up more than triple its minimum €250m target in the first trade to hit screens since the UK vote.

-

In an encouraging move for European markets after the volatility induced by the UK's vote to leave the EU last week, the German State of Hessen has dipped its toes back into the public market, tapping a July 2026 line for €875m.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

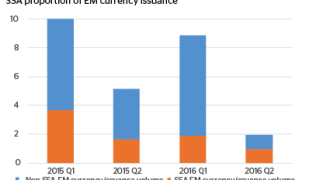

Undeterred by political risks, investors are moving back into emerging market currencies in an effort to combat the wafer thin or, in some cases, negative yields in core markets. Lewis McLellan reports.

-