Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

Specialisation could define MTNs in 2020 as the market looks to differentiate itself from public markets where borrowers are easily executing large, cheap, liquid benchmarks. MTN dealers’ change of focus is shaking up the league tables. Frank Jackman reports

-

US rate cuts were, admittedly, the driver behind the Latin American international bond market’s return to form in 2019. Although regional growth remains disappointing, there are encouraging technical and fundamental signs to be found

-

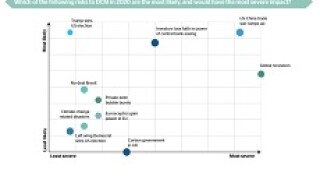

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

Equities are at record highs, rates at record lows; the US is quarrelling, China is slowing. As 2020 begins, participants are divided on which way markets will move. Toby Fildes picks 10 themes

-

An unusual note of optimism defines the attitude of Europe’s public sector issuers as they approach 2020. While many other markets are beset by fears of a slowdown in global growth, trade wars, and Brexit, SSA borrowers are confident in their borrowing strategies and loyal investor bases. Despite a change of face in the ECB’s top job, rates are still set to remain low for the foreseeable future. Accordingly, investors are having to grit their teeth to stomach the scanty yields on offer for euro SSA assets. Although SSAs are offering little in the way of yield, their place as pioneers of the evolving SRI market always ensures lively debate. In this roundtable, held in early November, market participants on both the buyside and the sell side favoured a more holistic assessment of issuers’ ESG profiles, rather than relying on labelled assets, but whether or not the ECB should take a role in promoting the SRI market through “green QE” divided the group.

-

2019 proved more fruitful for supranational, sovereign and agency borrowers than was expected in 2018 — in part thanks to a rejuvenation of the ECB’s asset purchase programme and a wholesale return to dovish monetary policies. GlobalCapital’s SSA team used its editorial judgment, with inspiration from GC’s world famous bond comments, to pick the top trades of the year. We strove to find deals that were not just the biggest, but that set pricing markers, were innovative and brave, or made an impression in other ways. GC presents the winners here. Congratulations to the issuers and banks involved.