Spain

-

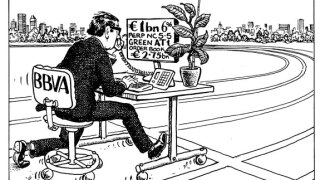

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

-

Bankinter continued the additional tier one (AT1) supply spree on Thursday, becoming the third issuer to launch this type of bond this week and receiving praise for the 6.25% coupon it achieved.

-

BBVA became the first financial institution to issue green debt in additional tier one (AT1) format on Tuesday, launching a bond with a 6% coupon. The Spanish lender left no premium on the table, according to some market participants.

-

European banks are looking to tie up loose ends in their 2020 funding plans in next couple of weeks, according to deal arrangers, as they get ready for a remarkably uncertain summer period. Tyler Davies reports.

-

CaixaBank attracted plenty of demand for its first Covid-19 bond on Wednesday, printing a €1bn deal at a spread that was through the fair value implied by its outstanding securities.

-

A worsening in credit conditions has squeezed some borrowers across EMEA out of syndicated loans and into the bilateral market. As syndicated loans bankers face another year of disappointing figures, market players are split over whether this trend will leave a more permanent dent in volumes. Mariam Meskin and Jon Hay report.

-

BBVA is the latest large European bank to have suffered a ratings downgrade during the Covid-19 pandemic, with Fitch having moved the issuer’s debt ratings down by a notch blaming a weaker operating environment in Mexico and Spain.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark and bid-yields from the close of business on Monday, June 22. The source for secondary trading levels is ICE Data Services.

-

Green bonds made up the majority of the supply in the euro bank bond market on Thursday, with Hypo Noe and Santander capitalising on strong demand for the asset class.

-

Banco de Sabadell proved very popular with a short-dated euro senior deal this week, after issuing in an unusual three year non-call two maturity structure.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark and bid-yields from the close of business on Monday, June 15. The source for secondary trading levels is ICE Data Services.