Société Générale

-

After a sharp slump in corporate finance revenues, investment banks are facing an uncertain second half of the year. If previous downturns are a guide, job cuts will be inevitable before a new market reality emerges to trigger the next wave of capital markets and M&A activity. By David Rothnie

-

The sustainability-linked loan found solid demand, with the deal landing at $912m

-

-

Issuer attracts €32bn of demand in encouraging sign for other borrowers

-

Issuer draws smallest demand in years despite Moody’s upgrade this week

-

Société Générale paid a hefty premium to access the dollar market on Wednesday as banks and other financial sector issuers continue to adapt to higher funding costs to get deals over the line.

-

Issuer overcomes worries of low levels of interest for long euro debt

-

Combined company Forvia aims to be a leader in car batteries and electronics

-

SocGen needs to find a solution quickly to its succession issue as it looks to avoid mission creep. David Rothnie assesses the internal and external candidates

-

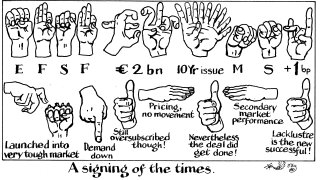

Investors still favouring liquidity, but smaller issuers can get deals done

-

Euro pipeline builds as KommuneKredit and Andalucia mandate for ESG bonds

-

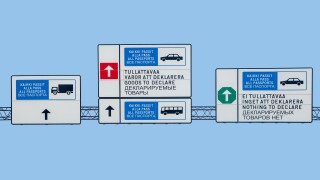

Russia neighbour cruises through busy sovereign market that also hosts France linker