Top Section/Ad

Top Section/Ad

Most recent

LatAm agency brings second digital bond this year in the currency

New firm mine. aims to build 'institutional memory' for borrowers

First use of sterling tokenised deposit to buy tokenised Gilt

More digital bonds are expected from the region this year

More articles/Ad

More articles/Ad

More articles

-

Swift, the provider of messaging services for financial institutions, is opening its know-your-customer (KYC) registry to corporates, which it says will save time for both international companies and their banks.

-

Trading network Liquidnet has appointed Brian Conroy as president with a mandate to grow the business organically and through acquisitions.

-

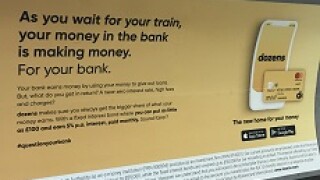

Dozens, the latest digital banking offering, aims to revolutionise retail banking in favour of the customer, by routing returns back to depositors and avoiding most unsecured consumer lending. Is this an unworkable goal, or is founder Aritra Chakravarty on to something?

-

The European Central Bank (ECB) is looking to set up its own platform in collaboration with the Sociedad de Gestión de Activos procedentes de la Reestructuración Bancaria (Sarreb) in order to shift European non-performing loans (NPLs).

-

A few years ago, artificial intelligence was only the hipster’s choice for ‘most important tech innovation in finance’. But AI is fast supplanting blockchain as The Next Big Thing in capital markets. There is a theory that cool things are no longer cool once finance types start to like them. So, in that spirit here’s ByteMe’s guide to the perils of an AI dystopia.

-

Technology M&A will continue to power corporate finance activity in 2019 but, as deals increasingly cross sectors, banks are having to re-tool their coverage and break up internal silos, writes David Rothnie.