Top Section/Ad

Top Section/Ad

Most recent

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

Originator hired to go after bank bond issues in euros and dollars

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead

More articles/Ad

More articles/Ad

More articles

-

The European IPO market ended 2019 in soul-searching mood, following a tremendously problematic year. Issuers may look for alternatives should market conditions persist through to 2020

-

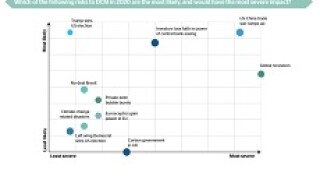

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

The must-have new business line in capital markets is raising capital for companies that might be nowhere near coming to market. Tech companies stepping outside the private markets have stumbled this year, but banks still hope to take a slice of a fast-growing pie

-

We have more multilateral development banks than ever before. They perform an invaluable job in a challenging and ever-changing world, but as they expand, and as new MDBs emerge, a fear is growing that they are being used as political tools by sovereign shareholders, keen to promote their own interests around the world. By Elliot Wilson

-

Credit Suisse expects to make a pre-tax loss in its investment banking and capital markets (IBCM) division this year, it said at an investor day on Wednesday. But it pointed to a strong pipeline for 2020.

-

Deutsche Bank has told investors that its investment bank is back on track. Cutting costs will be a crucial part of reaching growth targets. But after so many false starts, can it really be that simple, asks David Rothnie.