Top Section/Ad

Top Section/Ad

Most recent

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

Originator hired to go after bank bond issues in euros and dollars

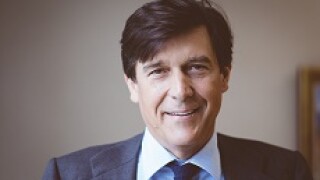

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead

More articles/Ad

More articles/Ad

More articles

-

HSBC and Standard Chartered are facing a backlash from investors and politicians after publicly supporting China’s planned security law for Hong Kong.

-

Robert Begbie has been appointed permanent chief executive of NatWest Markets, while David King, formerly head of MUFG Securities in Europe, the Middle East and Africa, becomes chief financial officer.

-

A $5bn take-private of Spanish telecoms operator MasMovil is the first sign of the return of M&A deal-making. But as bankers work frantically behind the scenes to rebuild the market, the big, integrated houses look set to dominate, writes David Rothnie.

-

The structured products market may have suffered dramatic blow-ups in the equity market, but investors have supported the less well publicised fixed income corner of the market.

-

Nomura is eyeing acquisitions and a change in chief executive promises a reboot of its investment banking ambitions, writes David Rothnie.

-

Citigroup’s new architecture to make its banking, capital markets and advisory (BCMA) group a fitter competitor in sustainability and ESG issues emphasises two channels of communication, according to Manuel Falcó, co-head of BCMA, through the most senior rainmakers and a cadre of younger enthusiasts.