Top Section/Ad

Top Section/Ad

Most recent

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

Originator hired to go after bank bond issues in euros and dollars

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead

More articles/Ad

More articles/Ad

More articles

-

Deutsche Bank is set to lose the head of its European investment grade credit trading business.

-

The Basel Committee on Banking Supervision (BCBS) published its final version of new rules for trading assets at banks. The rules will push up market risk regulatory capital requirements by 40% – but are still far less punitive than the industry had feared, especially for the securitization market.

-

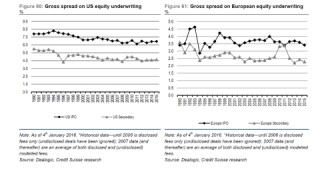

After a year when European banks took their lowest ever share of investment banking fees, 2016 is not shaping up to be much better. Credit Suisse’s bank analysts noted continued low fees in the European market, which is set to continue into 2016 and 2017.

-

Standard Chartered has revealed the new management structure of its global capital markets team following a highly publicised restructuring last year. Leading the revamped capital markets unit is Henrik Raber, who told GlobalCapital Asia this week that he is confident the bank will be able to stand strong amid changes. Rev Hui reports.

-

One of BNP Paribas' most senior debt bankers, Tim Drayson, has left the firm.

-

In the wake of the news that four traders at different banks were under investigation by US and UK authorities over possible sharing of client flow information, senior bankers were quick to blame the structures of the market, and pressure from issuers focused on turnover statistics, for making it possible.