Middle East

-

Akbank opts for use of proceeds sustainable loan, others may drop ESG labelling altogether

-

The IPO pipeline in the region has been dominated by state owned enterprises but that could change

-

Timing on Denizbank and Isbank syndication launches clearer as Turkish bank loan refi season continues apace

-

Trade prices inside the curve of Abu Dhabi peer Mubadala

-

Privately owned Dubai supermarket group is set to begin trading next week

-

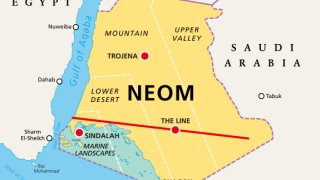

Only Saudi banks provide facility, as Western banks say the lack of ancillary opportunities makes the business case difficult

-

Orders for the debutant's deal were building 'nicely'

-

Dubai supermarket group's IPO is multiple times covered, say sources

-

Debut trade from ADQ has been long-awaited, said one DCM banker in the Gulf

-

A liquid market for follow-on share sales is the next step for the region’s equity capital markets

-

OCP and Sisecam dual tranche dollar deals fly, Kuwait International Bank sells AT1

-

Abu Dhabi book $15bn at first update, Apicorp mandates