Middle East

-

The Sultunate of Oman is starting the roadshow for its dollar benchmark 144A/Reg S bond on Thursday.

-

Kuwaiti petrochemicals firm Equate is taking its time to refinance $6bn of loans, with bankers blaming the tight pricing and deal size for the slow progress of the self-arranged transaction.

-

Republic of Turkey is looking to take its next chunk of funding in the Islamic market, just days after President Erdogan called for Muslims to reject contraception to ensure the continued growth of the Turkish population.

-

The swathe of rights issues set to form a big part of Emea equity capital markets activity this side of the summer has moved forward this week, with the conclusion of Dubai Parks and Resorts’ deal and the launch of SSAB’s prospectus.

-

Dubai banks are stepping into the loan market as Commercial Bank of Dubai refinances a $450m three year loan, while Emirates NBD nears close for its deal.

-

Turkey’s use of the public-private partnership infrastructure model has proven effective, with the healthcare sector leading the way. Underdeveloped capital markets, insufficient international bank lending and political instability, however, are some of the numerous challenges the sector faces in sustaining its progress. Max Bower reports.

-

Currency volatility and political upheaval are proving difficult hurdles to clear for Turkish companies wanting to graduate from domestic loan markets to the international capital markets. Elly Whittaker reports.

-

Competition is becoming much fiercer in the Turkish banking sector. After years of rampant loan growth in many markets, banks will have to fight much harder to find new customers and bigger margins in the future.

-

Turkish banks are looking to mortgage-backed covered bonds to close asset and liability mismatches and reduce borrowing costs. In the next few years, the asset class will become a cornerstone of their funding plans. Tyler Davies reports.

-

Political uncertainty has provided a volatile backdrop for investors in Turkey over the last year, making the growth in its economy all the more impressive. But as Philip Moore reports, the country’s economic resilience will be severely tested this year.

-

Buttressed by vibrant domestic demand and supported by weak global commodity prices, Turkey’s economy continues to post solid growth. In this interview, treasury undersecretary Cavit Dagdas explains how Turkey’s medium term programme (MTP) will underpin continued growth.

-

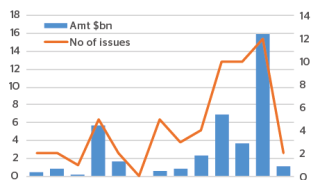

Qatar made history on Wednesday by printing the largest ever bond from a CEEMEA borrower. The triple tranche $9bn trade surpassed size expectations, and while initial teething problems saw the five and 10 year tranches soften in secondaries, rival bankers deemed the pricing a triumph.