Loans and High Yield

-

Telecoms firm Lebara is seeking further changes in its bond terms, including waivers on leverage covenants and a shorter maturity date, after it finally released group financial results which have been delayed since February.

-

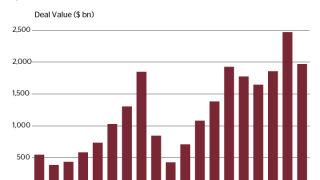

The leveraged finance market has been the best business for capital markets banks this year — but rising debt levels, weakened investor protections and the rapidly growing volumes have brought regulatory attention. Some banks are pulling back from the most aggressive deals, but others are taking their place, and a burgeoning non-bank lending sector is keeping the market white hot regardless.

-

Sustainability is conquering finance — to judge by what the industry likes to talk about. Outside the window, the real economy continues much as before. Is all the noise about green finance actually shifting capital in the right direction — or is it just making people feel better?

-

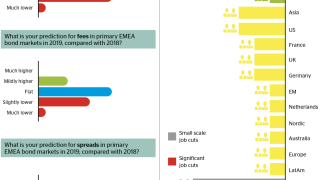

Pain from Brexit, higher interest rates, quantitative easing ending and political strains in the EU will all lead to more volatility in 2019, according to 22 heads of debt capital markets in the EMEA market, including 18 of the top 20, in Toby Fildes’ annual outlook survey. And that’s before Donald Trump, Vladimir Putin and Mohammed bin Salman get going. There is some good news, however: financial institutions are set to be big issuers, and the DCM heads expect to be net hirers...

-

Zhongyu Gas Holding has returned to the offshore loan market for its second borrowing this year, offering a $250m three year facility.

-

Bonds issued by China’s Kangde Xin Composite Material Group plummeted in the secondary market on Monday, losing around a third of their value after rumours of an onshore default.

-

Zhengzhou Metro Group became the latest Chinese local government financing vehicle (LGFV) to price a dollar bond, turning to the market on the same day two issuers in Chengdu and Yichang also raised funds.

-

Fantasia Holdings Group Co locked up a final dollar deal of the year on Thursday, but paid a generous 15% yield to secure anchor orders for the transaction.

-

Credit Suisse used part of an investor day on Wednesday to offer a staunch defence of its leveraged finance business, which forms a larger part of its investment banking and markets business than at its major competitors, but which has seen increasing regulatory scrutiny this year.

-

Spanish supermarket group Distribuidora Internacional de Alimentación revealed a new scheme to solve its financial troubles this week, away from the potential debt cut and cash injection recently suggested by its largest single shareholder, LetterOne.

-

Record numbers of speculative grade bonds have exceeded the limits of the European Central Bank's leveraged lending guidelines, research from SEB showed this week.

-

Chinese sportswear company Anta Sports Products is in talks with its six-strong bank group, mulling the syndication strategy for a €2.2bn five year loan to support the acquisition of Finland’s Amer Sports Oyj.