Top Section/Ad

Top Section/Ad

Most recent

US issuers and insurance companies could benefit as Moody’s relaxes parts of its approach

Investors attracted by relative value versus loans but are not blind to risk

Floridian manager registered the vehicle in Ireland with article 8 SFDR classification

More articles/Ad

More articles/Ad

More articles

-

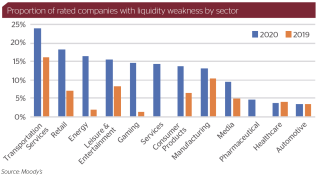

Fresh fears are rising about the future of companies already pummelled by the economic ramifications of the coronavirus pandemic. New research suggests that the worst affected industries will be the hardest hit again as Europe heads into another round of major lockdowns.

-

Indonesian high yield companies that had limited access to the international bond market this year due to the Covid-19 pandemic are now preparing for a challenging 2021 — unless sentiment gets a dramatic boost from the vaccine news. Morgan Davis reports.

-

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

Corporate finance in 2020 was utterly without precedent. Never before had so many once-stable firms seen revenues evaporate instantly, with so little visibility on when the world might recover. Companies did whatever they could to hang on, pulling every lever available to source scarce cash. As 2021 begins, so will a new phase, where the fallout of the Covid rescue playbook becomes clear. Owen Sanderson reports.

-

There could be more large restructurings in Europe in 2021 than ever before, as companies seek sustainable capital structures after 2020’s rash of emergency financing. But it’s also a new horizon for the laws that govern restructuring, as countries replace a patchwork of dated and difficult insolvency regimes, and the UK exits the European Union, ending automatic recognition of its court rulings. Owen Sanderson reports.

-

Nick Jansa turns up at Canadian pension fund — Rocket man touches down at Citi — Credit Suisse hires Gaurav Arora