LBBW

-

Norwegian issuer SR Boligkreditt and New Zealand borrower Westpac NZ will both take new euro deals on the road before the end of May, and the UK’s TSB has confirmed covered bonds will form part of its long term funding.

-

Landesbank Baden-Württemberg has issued the first European covered bond denominated in dollars this year, boding well for further supply from European banks in the currency.

-

Uncertainty regarding the outcome of the US Federal Open Market Committee’s (FOMC) meeting in June drove public sector borrowers to target the short end of the dollar curve this week, said bankers.

-

LBBW, OP Mortgage Bank and Mortgage Bank of Finland took little time to sell their benchmark euro deals this week.

-

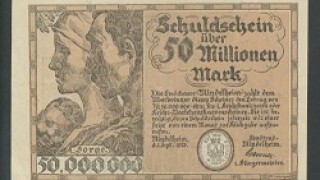

The world’s largest salt producer, K+S AG, has signed its first Schuldschein, a €600m deal.

-

KommuneKredit and the State of North Rhine-Westphalia (Land NRW) joined NRW.Bank in lining euros deals on Tuesday in a week bankers had expected to be hobbled by holidays.

-

Funke Mediengruppe, the German media group, has agreed an extension to its loan facilities, in one of the few amend-and-extend operations so far in 2016.

-

Eurofima was the sole issuer testing the euro waters on Monday, with bankers expecting a quiet second half of the month in the market after a frantic start to April in which issuers placed 12 benchmark deals.

-

German airline Lufthansa boosted its latest Schuldschein to €475m, pulling big tickets from Chinese banks, while two debut UK issuers set out to test the market.

-

-

The primary covered bond market was active this week with as many as seven issuers raising more than €6bn, including the longest deal in over a year and a debut borrower in euros.

-

The European Investment Bank and the European Union kicked off April by printing impressive benchmark deals, yet despite this strong start to the quarter SSA bankers fear that a combination of the threat of a Brexit and the low yields on offer in the euro market will make conditions extremely challenging for issuers.