LatAm Bonds

-

While it is tempting to think of capital markets-friendly President Mauricio Macri as having wiped Argentina’s slate clean, it is not yet time for EM investors to forgive and forget.

-

Panamanian lender Multibank sold $300m of five year bonds on its first US bond market outing on Monday.

-

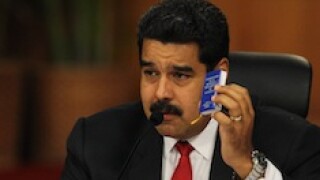

President Maduro’s surprise restructuring announcement only makes things murkier for Venezuelan bondholders.

-

Despite Venezuela offering some further colour on its proposed debt restructuring on Friday, the government’s plan is still unclear as its bond prices plummeted.

-

Brazilian investment bank BTG Pactual is looking to buy back 30% of old perpetual notes via a tender offer it will finance with cash.

-

Venezuelan president Nicolás Maduro’s announcement on Thursday that he would restructure the country’s debt left bondholders in “no man’s land”, after he appointed a politician that no US person is allowed to deal with as head of the restructuring group.

-

Mexican baked goods company Grupo Bimbo and a Panamanian bank are ready to bring variety to Latin America’s bond market next week after meeting bond investors this week.

-

Argentine lender Banco Hipotecario and Colombian utility EPM sold local currency deals on the international market this week but market participants said a limited buyer base is restricting momentum in these types of trades.

-

Inkia Energy, the Latin American power generation and distribution holding company, returned to the bond market on Thursday with a deal that divided opinion on relative value but performed strongly in the grey market.

-

Argentina this week jumped on momentum driven by the government’s impressive recent election performance to attract €11.5bn of orders for a triple tranche euro denominated bond — including a 30 year note that is rarely seen in the currency from EM borrowers. Oliver West reports.

-

Waiting for a default on Venezuela’s bonds has been like waiting for Godot. Low oil prices and macroeconomic mismanagement have led to a catastrophic collapse in economic activity. Our colleagues in country risk are forecasting a 7.5% GDP contraction.

-