KfW

-

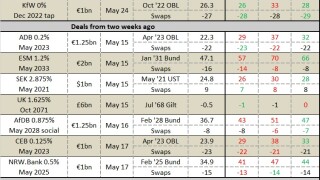

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

-

KfW opened the door for dollar issuers after a quiet few weeks in the currency, although the issuer — and SFIL, which followed it — had to navigate some price discovery after last week’s Italy-led volatility.

-

Public sector borrowers had one of their busiest weeks of the year in sterling, with a supranational trade in particular getting a strong reception. More could follow next week, with demand strong from Asian investors, said bankers.

-

KfW reopened the public sector dollar market on Wednesday by picking up a hefty $4bn from a well oversubscribed book. Société de Financement Local will be next up, after mandating banks for a trade.

-

KfW will bring what bankers say will be the first “real jumbo test” for the market since a wave of Italy-led volatility hit bonds last week.

-

The political manoeuvrings in Italy’s path to being governed — as well as poor eurozone economic data — played havoc with rates this week, leading to SSA deals either paying higher new issue concessions, or falling short of subscription. More volatility could come, after the country’s president approved the likely coalition partners’ choice of prime minister but held back from appointing a eurosceptic economist to take charge of the country’s economy. Craig McGlashan reports.

-

Dexia Crédit Local scored what leads said was a good result on Thursday as it brought a trade at the upper end of its size plans and tightened pricing during another volatile day for eurozone rates. KfW was also out in euros, with a tap, although it appeared to be more of a slow burner.

-

A supranational dollar deal ran away with April’s top spot in BondMarker, outstripping the rest of the table by a good margin and clocking in as the third most highly rated deal of the year.

-

BondMarker voters scored three deals last week, including the European Financial Stability Facility’s last helping of funding for the second quarter and an arbitrage style trade by KfW. Read on to see how the deals were received.

-

A solitary syndication from KfW broke the otherwise placid waters of the public sector debt market on Wednesday.

-

A solitary syndication from KfW broke the otherwise placid waters of the public sector debt market on Wednesday.